Tax Exempt Life Insurance

Here we will understand how this exemptions works and more importantly when they do not work. Our clients buy insurance as an alternative investment to low risk low yield highly taxed investments like bonds gics etc.

Income Tax Benefit On Life Insurance Simple Tax India

Income Tax Benefit On Life Insurance Simple Tax India

However any interest you receive is taxable and you should report it as interest received.

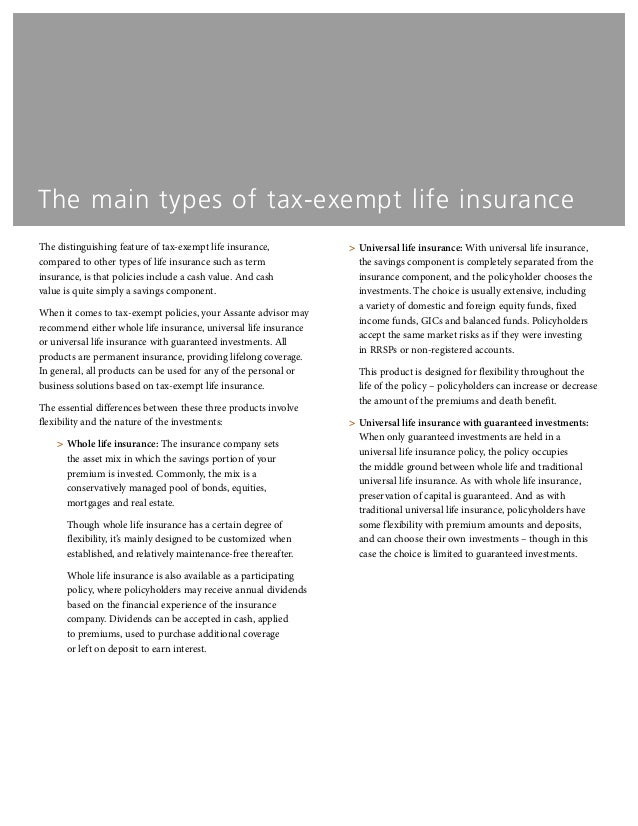

Tax exempt life insurance. Tax exempt life insurance offers two separate components of insurance and investments along with providing the entire spectrum of wealth planning. Life insurance policies offered by various life insurance companies in india qualify for tax benefits under the income tax act 1961this is an added advantage to a life insurance product that offers life cover to the individual. Purchase a life insurance policy which you feel is suitable for you as it not only offers you protection but also offers tax benefits under section 80c of the income tax act 1961 and section 1010d of the income tax act 1961.

See topic 403 for more information about interest. No income tax on the premiums paid for life insurance. Tax act assets accumulate within a tax exempt life insurance contract free of annual accrual taxation.

These insurance solutions can help with risk management tax and financial strategies along with wealth transfer. Most people know what life insurance is but dont know everything it can do. Tax exempt life insurance investment.

Although it is usually exempt from tax some life insurance payouts can be subject to inheritance tax. While various tax saving instruments are available life insurance policies are convenient and come with the basic feature of financial protection against death. Large number of individuals buy life insurance plans for the tax benefits they offer.

Tax exempt life insurance policies. Life insurance is still an excellent investment. Use our guide to learn about life insurance and tax and how to keep your life insurance tax free.

Those looking to accumulate money utilizing a tax shelter or deferral mechanism may wish to explore the benefits derived from a tax exempt life insurance accumulation planit should be noted that a substantial portion of the income from such investments is accumulated free of tax. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. When you pass away any proceeds of the policy are distributed to your beneficiaries on a tax free basis outside the scope of your estate bypassing its associated costs.

Use life insurance for a tax free estate plan new policies for older investors are costly but offer attractive tax free benefits for heirs. We will limit our discussion mostly to life insurance products.

Debt Diagnosis Forever Taxed Or Never Taxed If You Have

Debt Diagnosis Forever Taxed Or Never Taxed If You Have

Life Insurance Archives Page 2 Of 3 Yourinsurancelife

Life Insurance Archives Page 2 Of 3 Yourinsurancelife

Save Money With These Tax Tips For Homeowners

Save Money With These Tax Tips For Homeowners

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Budget 2019 Revised Section 87a Tax Rebate Tax Liability

Budget 2019 Revised Section 87a Tax Rebate Tax Liability

Because Life Insurance May Be The Most Underused Strategy To

Because Life Insurance May Be The Most Underused Strategy To

Does Estate Tax Exemption Apply To A Life Insurance Payout

Does Estate Tax Exemption Apply To A Life Insurance Payout

How Your Lic Premiums Can Help You Save Income Tax

How Your Lic Premiums Can Help You Save Income Tax

Strategic Tax Planning And The Large Case Market Ppt Download

Strategic Tax Planning And The Large Case Market Ppt Download

Key Facts Income Definitions For Marketplace And Medicaid

Key Facts Income Definitions For Marketplace And Medicaid

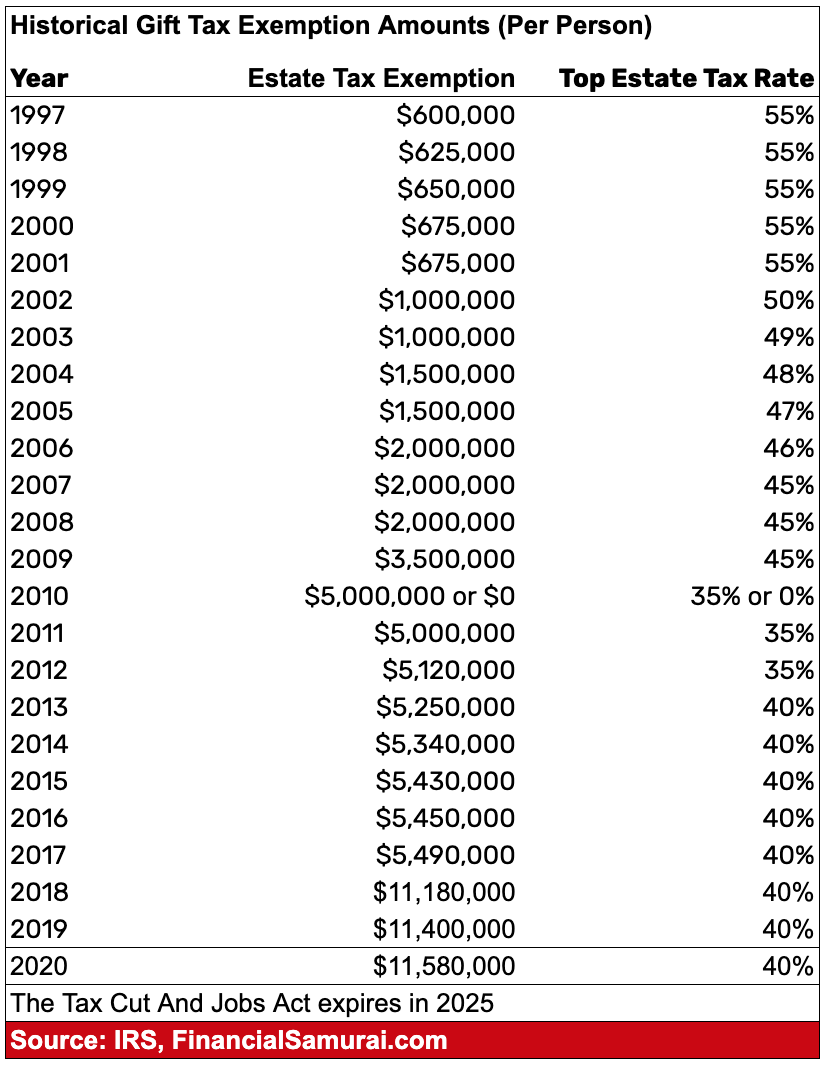

Historical Estate Tax Exemption Amounts And Tax Rates

Historical Estate Tax Exemption Amounts And Tax Rates

Life Insurance Premium Deduction U S 80c Simple Tax India

Life Insurance Premium Deduction U S 80c Simple Tax India

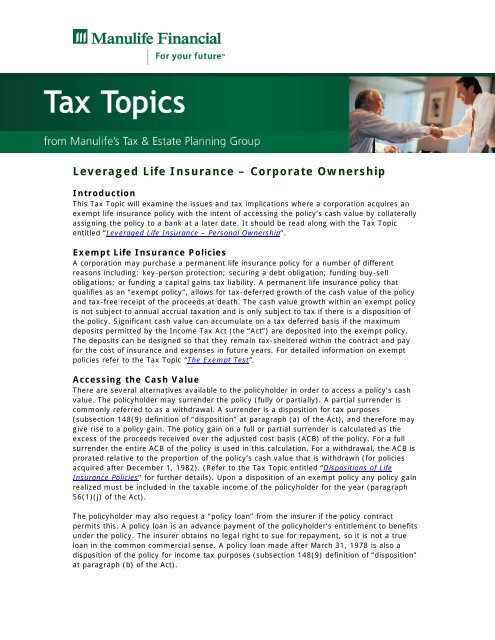

Leveraged Life Insurance A Corporate Ownership Repsource

Leveraged Life Insurance A Corporate Ownership Repsource

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

The Graph Depicts The Smoothed Average Life Insurance Ownership

The Graph Depicts The Smoothed Average Life Insurance Ownership

Income Tax Return On Salary From Life Insurance Policy Medical

Income Tax Return On Salary From Life Insurance Policy Medical

Tax Benefits On Life Insurance Linksking

Tax Benefits On Life Insurance Linksking

3 Ways To Protect Inheritance From Estate Tax Abs Cbn News

3 Ways To Protect Inheritance From Estate Tax Abs Cbn News

Need And Benefits Of Buying Life Insurance Plan By Alankit

Need And Benefits Of Buying Life Insurance Plan By Alankit

Pfa Guy Says Life Insurance Is A Tax Benefit Antimlm

Pfa Guy Says Life Insurance Is A Tax Benefit Antimlm

Income Tax Deductions List Fy 2019 20 List Of Important Income

Income Tax Deductions List Fy 2019 20 List Of Important Income

Komentar

Posting Komentar