Term Vs Whole Life Insurance Calculator

Term insurance policies are only active for a term and whole life insurance plans are going to give you a permanent form of coverage. Determine the type of life insurance you need.

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

Whole life insurance calculator.

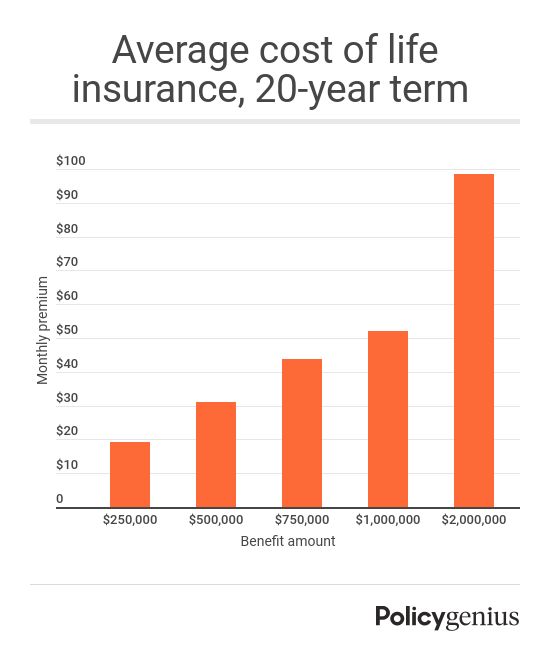

Term vs whole life insurance calculator. Well cover how to calculate the differences between term and whole life insurance and help you decide which option is best for your needs. The good news is that most people overestimate the cost of a term life insurance policy by at least 2x to 3x. Cost of life insurance.

The grief of losing a member is difficult to forgo but his financial responsibilities can be transferred to something called insurance in general and lifeterm insurance in particular. Aflac offers whole and term life insurance policies that help pay cash benefits directly. Learn more about how much life insurance you need.

Find out if term life insurance or a permanent life insurance policy is best. When analyzing term vs whole life insurance youll want to look at several different factors. Buying life insurance seems daunting.

So youll have more information when its time to get your quote for the cost of life insurance and buy your term life insurance policy. Term life insurance is affordable and straightforward while whole life doesnt expire but is more expensive. Term life insurance is cheap because its temporary and has no cash value.

Compare cost and policy features. Life insurance is cheaper when youre young and increases 8 10 per year. One needs clear understanding about the types of insurance term insurance vs whole life insurance before actually opting for insurance.

Having the right amount of life insurance will give you peace of mind that your loved ones will be financially secure. Whole life insurance costs more because it lasts a lifetime and does have cash value. Our term life insurance calculator includes economic forecasting which models income growth and growth of money you put in savings.

There are several kinds of life insurance coverage that you can choose from but all of them are under two umbrellas. There are a number of factors that determine your life insurance premium including. Do you need term life insurance or whole life insurance.

Term life is typically better for people who want affordable coverage in the unlikely event of their earlier than expected death especially during a critical time in life such as parenting young children or taking on a larger mortgage. But most people can start shopping by making one key decision. Both types have their benefits and drawbacks.

Calculate your life insurance needs and find your life insurance rate.

Annuity What Is An Annuity How They Work Icici Prulife

Annuity What Is An Annuity How They Work Icici Prulife

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Types Of Life Insurance In Tanzania Daima Whole Vs Term Life

Types Of Life Insurance In Tanzania Daima Whole Vs Term Life

Term Life Insurance How It Works

Term Life Insurance How It Works

Lic Micro Bachat Plan Returns Calculation How To Plan

Lic Micro Bachat Plan Returns Calculation How To Plan

Postal Life Insurance Premium Calculator Download Excel Home Life

Postal Life Insurance Premium Calculator Download Excel Home Life

Term Vs Whole Life Insurance Cost Cash Value Calculator

Term Vs Whole Life Insurance Cost Cash Value Calculator

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

17 Best Life Insurance Calculator Images Life Insurance

17 Best Life Insurance Calculator Images Life Insurance

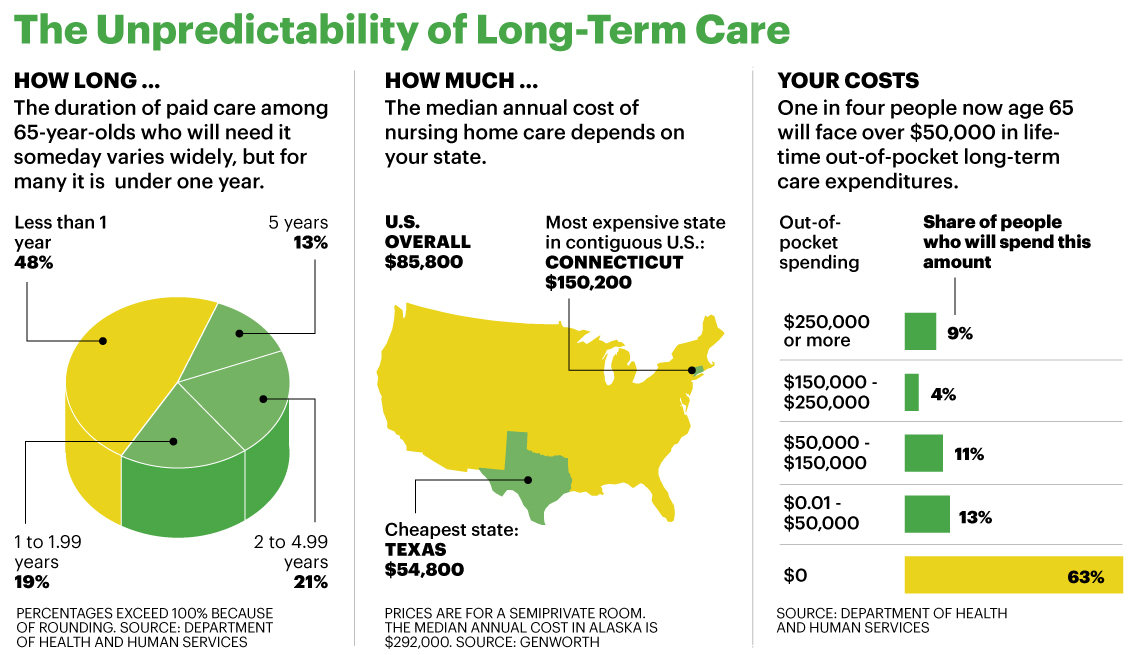

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

.jpg) How To Read Your Life Insurance Policy

How To Read Your Life Insurance Policy

Hd Exclusive Whole Life Insurance Quotes Calculator Squidhomebiz

Hd Exclusive Whole Life Insurance Quotes Calculator Squidhomebiz

Term Vs Whole Life Insurance Calculating Cost Cash Value

Term Vs Whole Life Insurance Calculating Cost Cash Value

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

The Pros And Cons Of Whole Life Insurance

The Pros And Cons Of Whole Life Insurance

Term Vs Whole Life Insurance Cost Cash Value Calculator

Term Vs Whole Life Insurance Cost Cash Value Calculator

How To Calculate Paid Up Life Insurance Amounts Finance Zacks

How To Calculate Paid Up Life Insurance Amounts Finance Zacks

Life Insurance Money Back Plan Return Calculation Using Ms Excel

Life Insurance Money Back Plan Return Calculation Using Ms Excel

Search Q Whole Life Insurance Cash Value Calculator Tbm Isch

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Komentar

Posting Komentar